Uncategorized

The #1 Bookkeeping Business Plan Template & Guidebook

Content

No certification is required for a paid preparer to sign a client’s tax return, but I highly recommend not preparing returns unless you’re a tax professional or willing to put in the work to become one. Many bookkeeping firms prepare financial statements that their clients take to CPAs or other tax pros to prepare a return. You may find yourself working closely with their tax preparer, and together, you can provide outstanding service to your mutual clients. An advisory board would include 2 to 8 individuals who would act as mentors to your business.

Our business bookkeeping market cuts across businesses of different sizes and industries. We are coming into the industry with a business concept that will enable us work with the small businesses and bigger corporations in and around Las Vegas – Nevada and other cities in the United States of America. We have a team that can go all the way to give our clients value for their money; a team that are trained and equipped to pay attention to details and to deliver excellent jobs. We are well positioned and we know we will attract loads of clients from the first day we open our doors for business. Provides managements with financial analyses, development budgets, and accounting reports; analyzes financial feasibility for the most complex proposed projects; conducts market research to forecast trends and business conditions.

Business Planning Course – Part 6

Therefore, the author assumes no responsibility for the success or failure of one or any of these steps contained in this book. Any reproduction of this book or the contents of this book, in whole or in part, for purposes other than inclusion in a personal business plan, are prohibited by law, without the written consent of the publisher. Home Inventory Business Plan Template & GuidebookGet everything you need to create a successful gun shop business plan and gain insight into the firearms industry with The #1 Gun Shop Business Plan Template & Guidebook. Learn how to write a detailed, goal-oriented plan that will help you run a prosperous and safe gun shop. Whatever your reason is to take the step to setting up your own bookkeeping business, the planning stage for any start-up is super important. Current services are either provided entirely by OWNER’S NAME or available through resources on the COMPANY NAME .

We’ve already talked about your ideal customer; your market and client research should help to inform you where they spend their time. Now let’s look at some common marketing channels you can use to promote your business. Bookkeepers who are just starting out often opt for sole proprietorship unless they have additional employees. Once you begin to hire additional staff, consider switching to an LLC or corporation model.

You get to establish your own management style.

Milestones could include sales goals you’ve reached, new store openings, etc. The second most common form of funding for a bookkeeping company is angel investors. Angel investors are wealthy individuals who will write you a check. They will either take equity in return for their funding or, like a bank, they will give you a loan. Choose a Structure – Different website platforms have many different styles and structures to choose from. Find a clean, manageable layout that will not distract visitors from your services.

They need to put the details regarding staffing, products, facility, and multiple other categories down on paper. Ultimately, they need to establish a simple, yet concise plan to use as a roadmap to success; a business plan.In Demand Business Plans can do this for you. Our plans were carefully put together by our experienced team to cover every essential facet of your business. “He who fails to plan is planning to fail.” Don’t plan to fail. Let In Demand Business Plans help you plan for success. COMPANY NAME is a small, successful, two-person accounting and tax preparation service owned and run by OWNER’S NAME, CPA in Puyallup, Washington. To move beyond a two-person model, the business will expand its services to more small businesses.

Get the Right Software

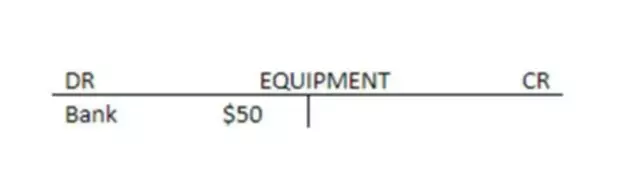

In order to create an effective business plan, you must first understand the components that are essential to its success. Direct cost wages for student bookkeepers’ billable hours are listed in the Sales Forecast. The wages shown for student bookkeepers in this table represent only training periods (non-billable hours) when new bookkeepers join the business. We will start with two part-time bookkeepers at the start of 2010, and increase to three midyear, adding a fourth in the second year and doubling the student bookkeeping staff to eight total in the third year.

- A bookkeeper is responsible for maintaining a company’s financial records, including recording financial transactions, reconciling accounts, generating financial reports, paying bills and issuing invoices to clients, and monitoring cash flow.

- Many are running initiatives to help small businesses by providing office space at a very low cost.

- It can also be a great way to track your business expenses easily—this will go a long way toward making tax time a breeze.

- Your executive summary provides an introduction to your business plan, but it is normally the last section you write because it provides a summary of each key section of your plan.

Mr. Chris Morgan graduated from both University of California – Berkley with a Degree in Accounting, and University of Harvard (MSc.) and he is a chartered account. Mark Lake has ample experience in the area of tax consulting and financial auditing. We will ensure that we hold ourselves accountable to the highest standards by meeting our client’s needs precisely and completely. We will cultivate a working environment that provides a human, sustainable approach to earning a living, and living in our world, for our partners, employees and for our clients.

Bookkeeping Business Plan – How To Develop It?

A comprehensive business plan also builds credibility with potential clients by demonstrating professionalism and commitment to success. The level of competitions in the financial consulting services industry depends largely on the location of the business and of course the niche of your financial consulting services. If you can successfully create a unique brand identity for your bookkeeping and payroll services firm or carve out a unique market, you are likely going to experience less competition. As a standard and well – positioned bookkeeping and payroll service provider, we are ready to take advantage of any opportunity that comes our way. Chris Morgan Financial Consulting, LLC is going to offer varieties of services within the scope of the financial consulting services industry in the United States of America.